Authors: Barry Simon Graham (Group Co-CIO) and Michael Yaw Appiah (Group Co-CIO)

We believe 2024 will be seen as a metamorphic year in our “New Economic Order” exposition. Institutional investors are facing a changing landscape. The stability that defined the economic order over the past three decades, yielding strong returns and steady growth, has given way to a new era marked by heightened uncertainty. Factors such as geopolitics, rising interest rates, inflation concerns, climate change, disruptions in global supply chains, and growing social divisions contribute to an environment characterized by increased volatility and disorder. These challenges, coupled with radical shifts in public expectations of business and society, add complexity to predicting the course of future events, making the attainment of favorable returns more challenging. Amidst these complexities, Zinqular remains adept to seeing the “sunny side of shifting currents” and actively discern the profound structural shifts shaping our world.

We think 2023 was the year both private and public markets would prefer to forget; except for some very few sectors. China’s economy showed signs of deflation; Europe was “uneven” and a long-awaited U.S. slowdown never materialized due to: 1) U.S. economic growth was more resilient than expected in 2023; 2) robust consumer and 3) ample money supply in the economy albeit ongoing quantitative tightening (i.e., QT).

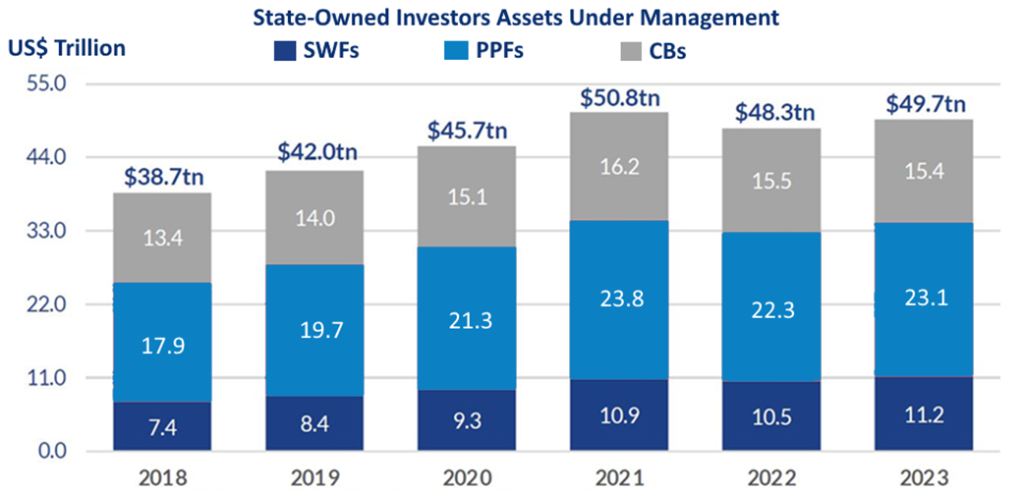

Global State-Owned Investors (SOIs), particularly Sovereign Wealth Funds (SWFs) and Public Pension Funds (PPFs), saw a surge in their assets (AUMs) in 2023, driven by substantial “paper” gains in financial markets, notably from SOIs heavily invested in the top 7 S&P 500 firms, referred to as the Magnificent 7. The SOI highlights for 2023 include (refer to Exhibit 1):

- SWFs nearly recovered from their trillion-dollar losses in 2022 and reached a peak of $11.2 trillion.

- PPFs witnessed an increase in assets to $23.1 trillion.

- Central Banks (CBs) maintained relative stability with assets nearly flat at $15.4 trillion.

The cumulative value of these three entities is poised to surpass $50 trillion, surpassing their 2021 peak by 2024 as they actualize the gains documented in 2023. We anticipate a positive outlook for SOIs in 2024.

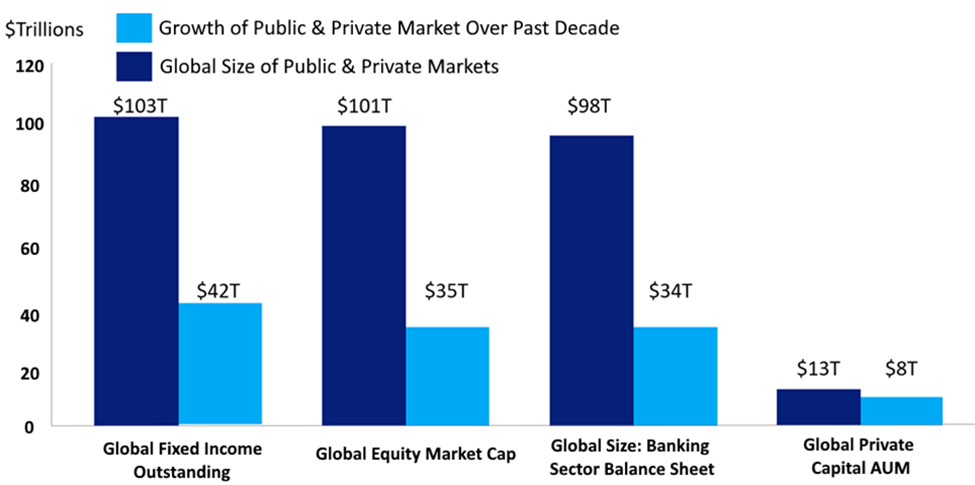

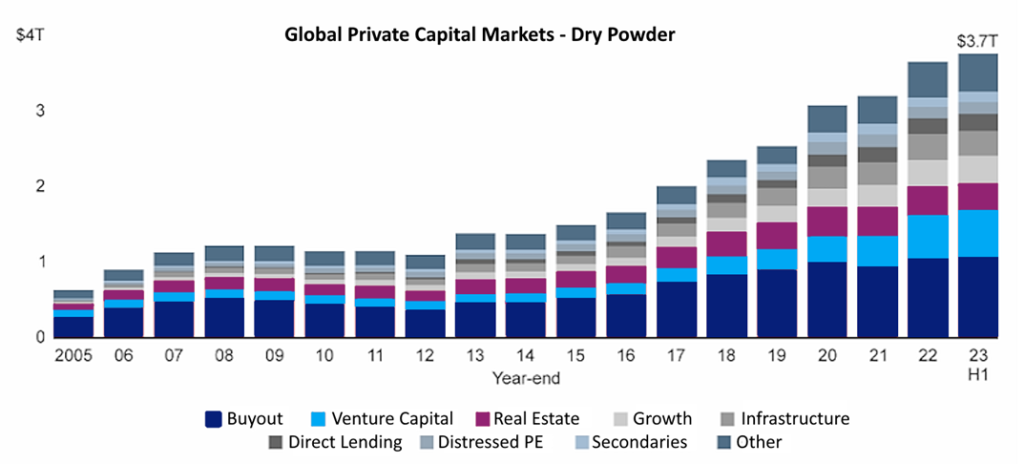

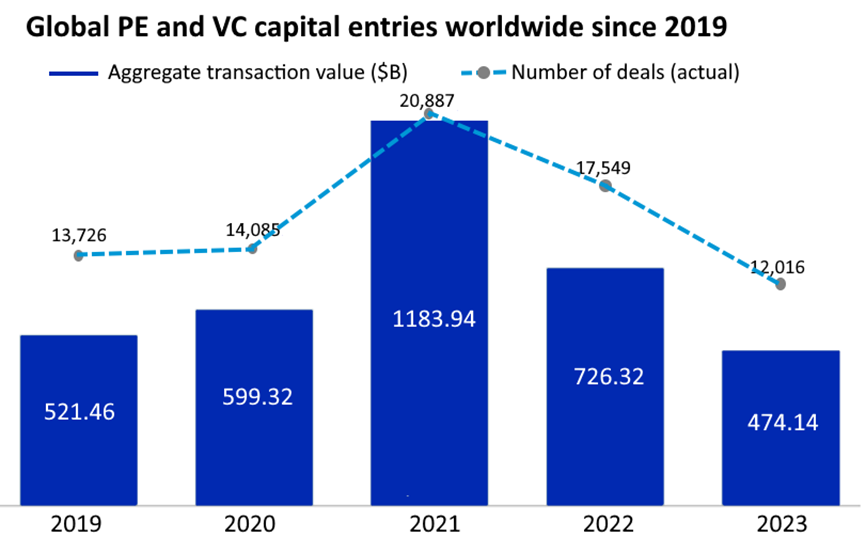

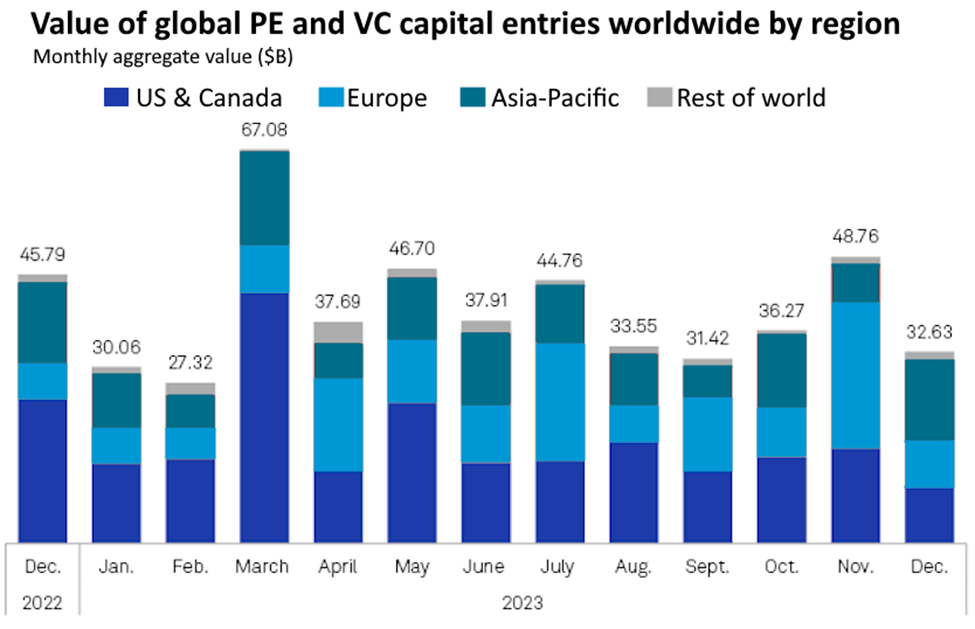

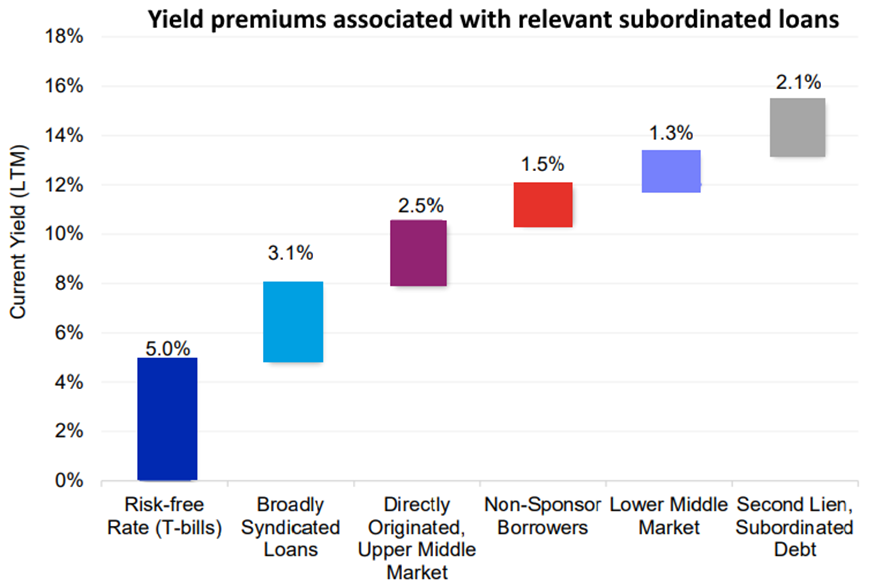

Exhibit 2, Exhibit 3, Exhibit 4, Exhibit 5, Exhibit 6, and Exhibit 7 provides a snapshot of state-of-play of private and public markets. Last year, private markets particularly private equity and private credit markets had few entries and few deals to tempt investors to reenter the game; even though private markets had $3.7 trillion dry powder (refer to Exhibit 5). We saw signs of recovery for private markets in the final months of 2023. One bright spot for private and public markets was interest in artificial intelligence (i.e., AI) firms and assets. Private markets investments strategy in datacenters indicates a “picks-and-shovels” investment amid an AI gold rush. For example, with datacenter firms hesitant to invest capital in multibillion-dollar expanded hyperscale facilities, private market funds are eager to invest at the right price. So far, deals have been slow to develop suggesting nervousness in the market

Quite recently, normal economic forecast has been quite challenging to say the least partly due to “tainted” data. The US markets and economy in general are behaving asymmetric to expected norms. We think continuous & far-reaching interventions by the US government, the Fed & Treasury’s since 2008 GFC means many signal indicators of the past for normal economic and business cycles have completely altered, and possibly “permanently”. For instance, US govt programs such as $280 billion CHIPS and Science Act, $780 billion IRA Act, $350B IIJA Act, Fed programs and liquidity injections either directly via QE or indirectly through the easing of financial conditions, we think will glide financial market upwards and move it considerably higher without any contribution from real economic activities.

Exhibit 1: Global State-Owned Investors (SOI) Almost Recovered from Their 2022 trillion USD Losses in 2023.

Exhibit 2: Comparing a Decade of Growth in Public and Private Markets. Contrasting the Expansion of Public and Private Markets Since 2013.

.

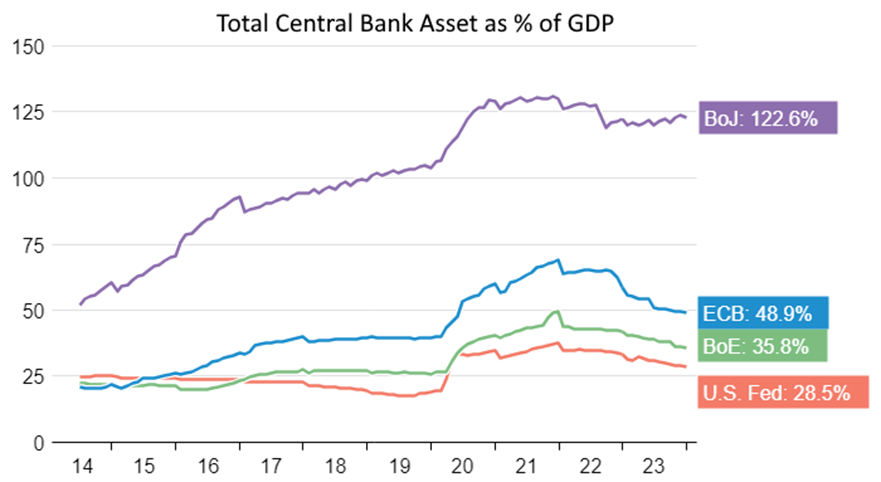

Exhibit 3: Global Central Bank (CB) Balance Sheet of All Assets as % of GDP. CB Injected more Liquidity into Financial System through QE and Other Programs.

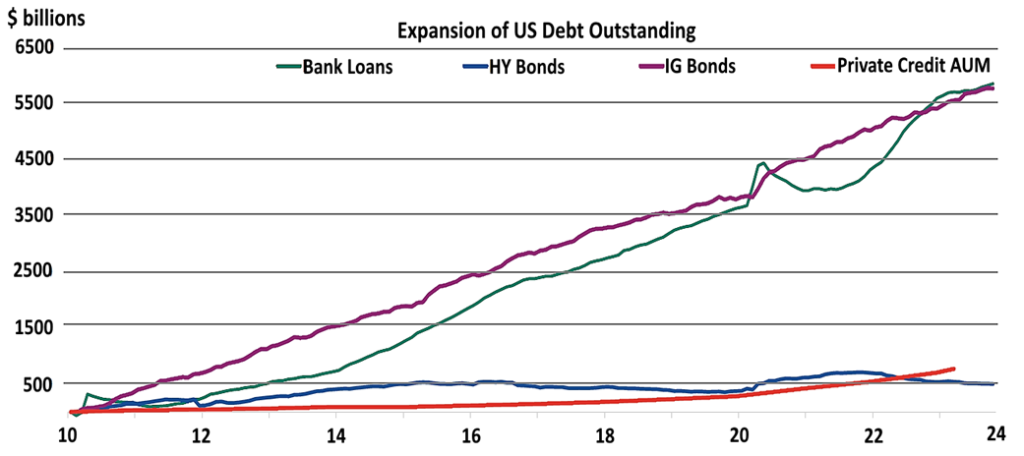

Exhibit 4: Since 2010, bank lending has surged by $5.5 trillion, IG markets witnessed growth of $5.5 trillion, HY markets expanded by $500 billion, and private credit AUM rose by $800 billion.

Exhibit 5: Global private equity dry powder has soared to an unprecedented $3.7 trillion in 2023 as a slow year in dealmaking closes with limited opportunities for firms to deploy capital raised in previous years.

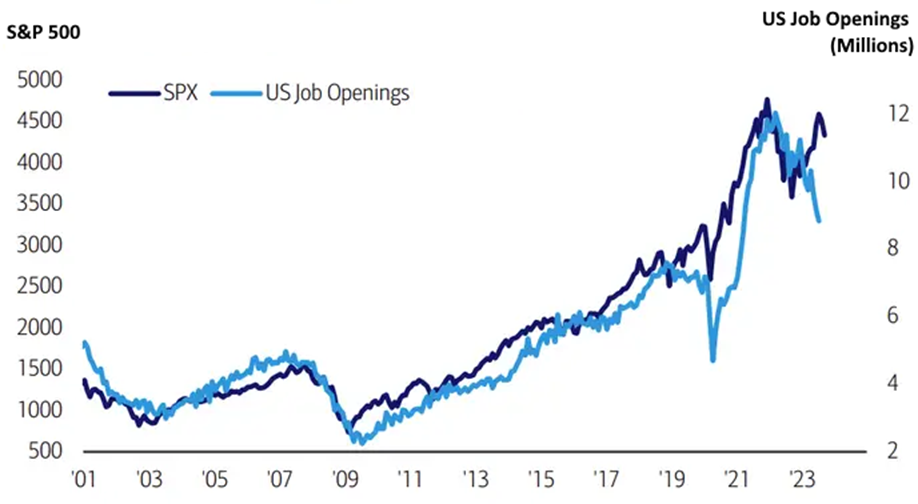

Historically, the S&P 500 has mirrored job openings. We do not witness that trend any more (refer to Exhibit 6). Normally, when S&P 500 climbs up; it signals robust economic growth and optimism, so does the stock market. However, the current cycle, we’ve seen a divergence; job openings have faded while S&P 500 keeps moving higher, representing a unique economic backdrop of 2023. If we are correct, then we think recession will be unlikely in 2024.

Exhibit 6: Historically, S&P 500 Mirrored US Job Openings. Not Anymore.

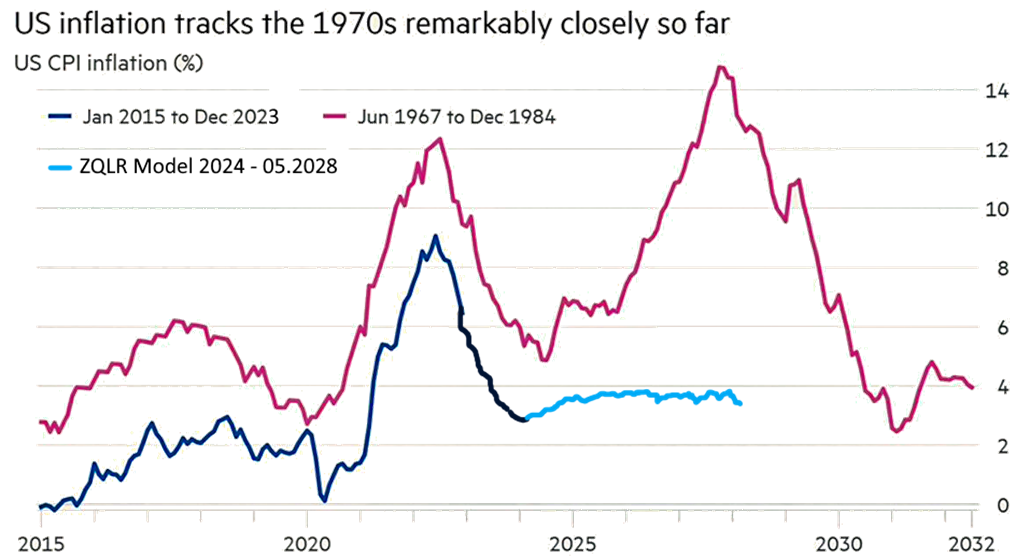

Particularly since the pandemic, we are of the view that temporary disinflationary trends and decelerating growth support a soft economic landing i.e., mild recession although we have not discounted full recession in the near term. This means pragmatic investors may have to construct their portfolios to take advantage of below consensus inflationary trend. We are also working on a solid premise of “higher for longer rates”. The macro take is to move towards how specific markets sectors and firms can navigate higher cost of capital and slower growth.

Sunny Side of Shifting Currents

Pervasive changes in both the economy and financial markets have set the stage for robust growth in private markets as 2024 begins. The impactful cornerstones at play today, as well as in the future, serve as defining factors for private markets. Private assets are poised to play a pivotal role in the ongoing transformative processes. A notable shift is evident in the banking sector, where institutions are strategically reducing their loan portfolios and implementing stricter lending standards. This shift not only opens up opportunities in private debt but also fosters an increased dependence on equity financing, presenting various avenues for collaboration between private market participants and banks.

A growing trend sees firms opting for more prolonged periods as private entities, underscoring the increased significance of private markets in the broader economic landscape. Private markets offer a more flexible and expeditious source of financing for firms navigating challenging macroeconomic conditions and shying away from public markets. Within client portfolios, private markets provide the advantage of tailored exposures to various sectors.

As we begin 2024, a noticeable shift is observed with less capital actively pursuing investment opportunities. Fundraising has faced challenges, prompting investors to exercise heightened selectivity. While specific asset classes and regions, notably North American infrastructure, experienced a decline in dry powder in 2023, the overall volume of funds on the sidelines has expanded (refer to Exhibit 5). Consequently, assets are on track for repricing, creating attractive entry points for new investment vintages concentrating on higher-quality companies and segments of the capital structure offering enhanced protections. The focus on deal structure remains a key consideration across private assets entering 2024.

Record dry powder accumulation is rooted in the robust M&A market of the last several years, which set high valuation expectations for sellers that remained elevated even as macroeconomic conditions increasingly slowed deal activity from 2022 onward. Buyers want lower asset prices, and the resulting valuation gap creates hesitancy to execute deals. Suddenly, macroeconomic issues happen in the market with interest rates and general economic variables and deals start to take longer, so more and more capital just starts to back up in the system.

Vital Cornerstones

Particularly, the five vital cornerstones within our “New Economic Order” core argument – Decarbonization and Net-Zero Transition; AI and Disruptive Technology; Breakdown of Geopolitical Unity and Revamping Global Supply Chains; Demographics and Sticky Labor Costs; and Evolving/Agile Finance 3.0 – implores a systematic and structured approach to asset allocation. As 2024 begins, we try to envision how the near-term and long-term may unfold. We see the sunny side and opportunities in the age of shifting economic currents and unpredictability – slowing and fragmented growth; higher rates; inflation and volatility.

The impactful major themes that have substantial and structural transformations shaping our world; themes that have our steadfast belief strategically as this year begin includes – Global Infrastructure; AI/Connectivity/Digitization; Industrial Robotics & Automation; Demographics and Future of Finance. Our view emphasizes the unique advantages of investors in navigating these ongoing shifting currents. The essential role of private capital is clear, whether in recognizing the significance of infrastructure in the transition or understanding the role of real estate in helping societies adapt to demographic change.

As we formulated our 2023 Outlook, our central idea was that “despite the turmoil in the global economy, our macro perspective, urged us to stay calm and go back to basics”. Twelve months later, as elaborated in this document, we persist in maintaining our optimistic perspective and recommend approaching the “sunny side of shifting currents” in the investment landscape.

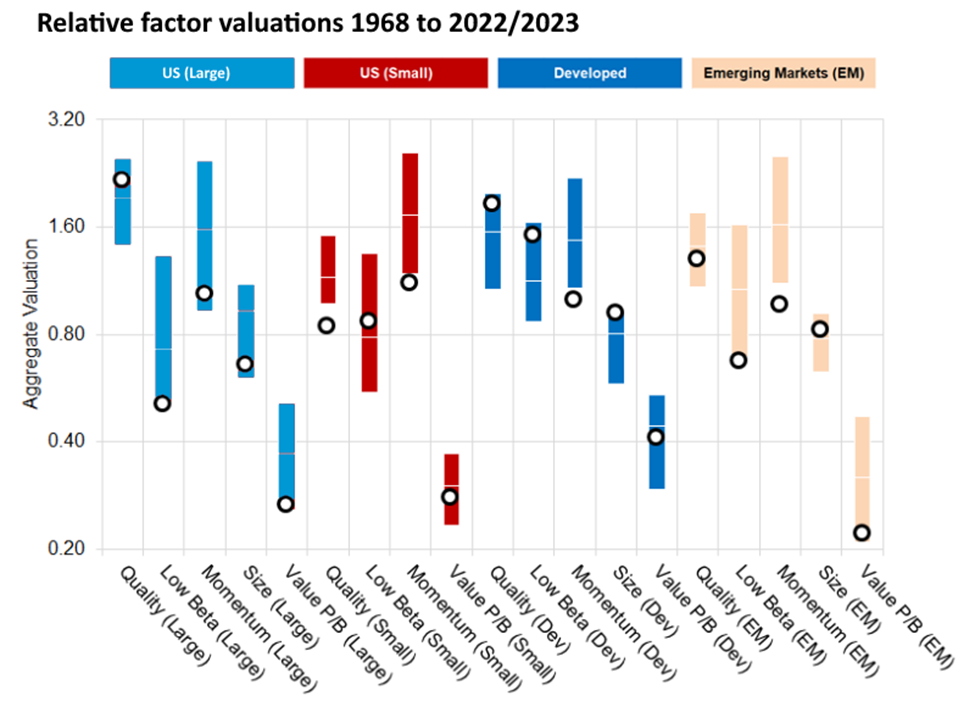

Once again, we want to stress this year that allocators willing to engage in thorough analysis will find a significant level of dispersion. The predominant factor contributing to this dispersion is macroeconomic unpredictability, and it spans across both asset classes and regions. This creates a substantial opportunity for long-term investors to unlock value, as depicted in Exhibit 11.

Crucially, we hold a different perspective from those who believe that the S&P 500 is trading at high headline valuations and that the US economy is peaking with an impending hard landing. Despite a prevailing notion that the market offers little value beyond Cash, reflected in the substantial $6 trillion assets in money market accounts, we disagree. Particularly in the core investing sectors and businesses overseen by Zinqular, we see compelling Equity stories. Beyond the ‘Magnificent 7 or 12’ in the S&P 500, there are noteworthy opportunities, especially for firms seeking capital for growth or business repositioning.

Aligned with this perspective, we believe that the current landscape offers public-to-private and carve-out opportunities that were not present four to ten years ago. Simultaneously, Liquid Credit appears undervalued, particularly when compared to pension and insurance liabilities. Additionally, various segments of the infrastructure sector, where we operate, continue to experience a secular bull market on a global scale. Lastly, due to periodic disruptions and an increasing need for refinancing, numerous opportunities for capital solutions arise within Asset-Based Finance and Opportunistic Credit, presenting attractive returns with potential equity upside in many cases.

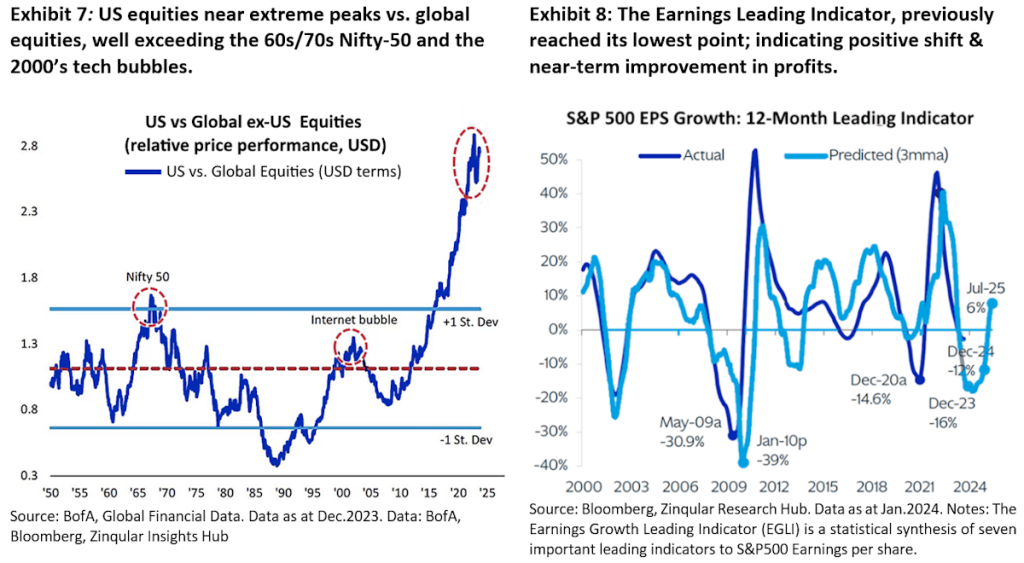

The 7 biggest firms on S&P 500 (i.e., Magnificent 7 or Mag 7) are approaching an all-time valuation relative to all other asset class combined than last seen during the dot-com bubble (refer to Exhibit 7). The narrow leadership by Mag 7 mirrors the late 1960’s to early 1970s, when investors only trusted blue chips (i.e., Nifty 50 firms such as IBM, GE, Exxon, GM, Xerox, etc..), and in the late 1990s, when high-flying tech stocks ran “wild”, creating the dot-com bubble. When the stock market crashed in 1973, the Nifty 50 defied gravity for a while, held up by institutional enthusiasm that created a two-tiered market of the richly priced Nifty 50 & the depressed rest. In both the early ’70s and late ’90s, the tape only broadened during recession, going against conventional expectations.

Fast forward to 2023; for starters, Magnificent 7 firms enjoy strong balance sheets, reliable cash flows and growing sales. They also suffered from a punishing bear market in 2022, which brought their valuations to levels that seemed compelling to many. Finally, Magnificent 7 firms are poised to be the biggest beneficiaries of the AI boom. The question though is: does the long-run performance of these investor favorites justified their seemingly high prices in a changing market dynamic, e.g., reduction of excess liquidity in the economy i.e., QT, very high public debts, high rates, possibility of recession & severe market contraction, etc.? We think should market dynamics negatively change then Magnificent 7 may be due for “partial” reset but not in the near term.

In periods of pronounced leadership imbalance (as it was then and is now), market dynamics can swiftly change, regardless of being in a bullish or bearish phase. The prospect of a long-awaited recession in 2024 could manifest within a broadening market, a scenario likely absent from the majority of investors’ expectations for the year.

Exhibit 9: Despite global macro challenges, we consistently see compelling themes that present “sunny side of shifting currents” investment opportunities.

From our standpoint at Zinqular, we maintain there is expansive opportunity set for investing in significant mega-themes observed in recent years; supporting our “sunny side of shifting currents” thesis for global allocators. Crucially, a number of investment opportunities we emphasize also function as compelling hedges and safeguards against some of the challenges facing the global economy in the present time (refer to Exhibit 9).

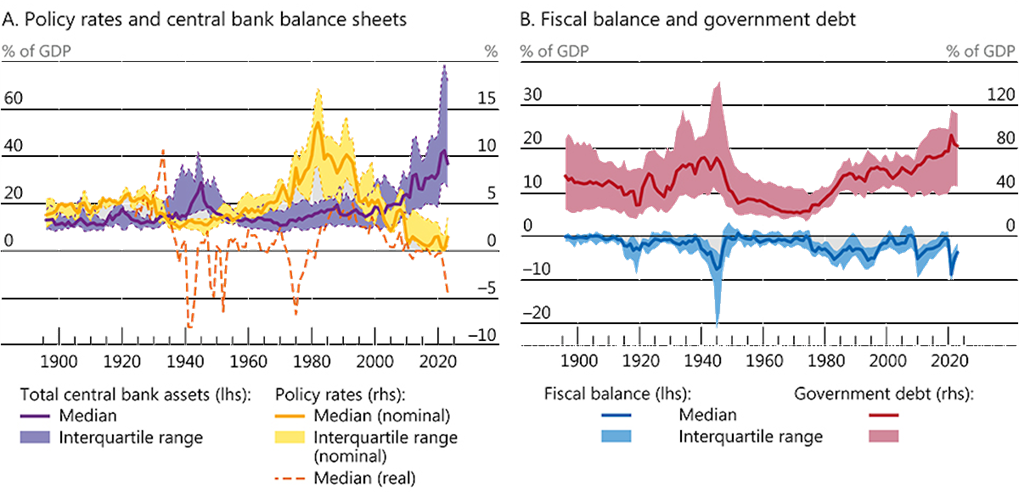

Looking back on the preceding 12 months, it’s undeniable that 2023 has been a turbulent journey, particularly with the intriguing ‘puzzle’ we observe—where a robust fiscal impulse is in contradiction with pronounced monetary tightening (refer to Exhibit 10). Drawing a comparison akin to an astronaut pilot, navigating through a sea of meteorites with navigation controls (i.e., managing fiscal policy), while simultaneously expertly guiding the spacecrafts with landing controls handling (i.e., monetary policy) in a complex planetary environment.

In the face of these competing influences, the spring witnessed the collapse of several major banks in the United States and Europe, triggering worries about a deflationary, deleveraging cycle. However, what initially seemed like a significant macroeconomic shock causing concerns about an economic collapse turned out to be a deceptive move. By fall, the narrative pivoted towards expectations of higher GDP growth and a notable surge in long-end rates, despite the ongoing impact of Russia’s war in Ukraine and escalating geopolitical tensions in the Middle East. It’s clear that 2023 markets swiftly rebounded in the opposite direction, placing their bets on an aggressive series of Fed cuts and leading to a sharp decline in bond yields.

Exhibit 10: Monetary and fiscal policy historical Conundrum. 2023 turbulent journey saw an intriguing ‘puzzle’ where a robust fiscal impulse is in contradiction with pronounced monetary tightening.

In the midst of the continuous ebbs and flows, Zinqular has steadfastly followed our “New Economic Order” playbook (refer to Excelling Beyond the New Era: 2022 Global Outlook). Summarily, our exposition relies on five fundamental pillars — a turbulent decarbonization /energy transition, escalated geopolitical complexities, de-globalization/localization, enduring labor costs, and ambitious fiscal policies. These factors signal a likelihood of heightened inflation during this cycle. Consequently, we propose a substantial realignment of asset allocation, advocating for assets more intricately connected to nominal GDP rather than heavily indebted financial assets such as government bonds tethered to the diminishing era of low inflation and low growth.

Our asset allocation strategy within our “New Economic Order” exposition has been effective thus far, characterized by ownership of collateral, short duration, and positioning higher in the capital structure. This strategy has resulted in consistent favorable outcomes, but a note of caution for 2024 is warranted. Three key factors differentiate the upcoming year: our geopolitical calls; our growth projections, with the exception of Europe, consistently surpass consensus, while our inflation expectations, excluding Japan, consistently lag behind consensus.

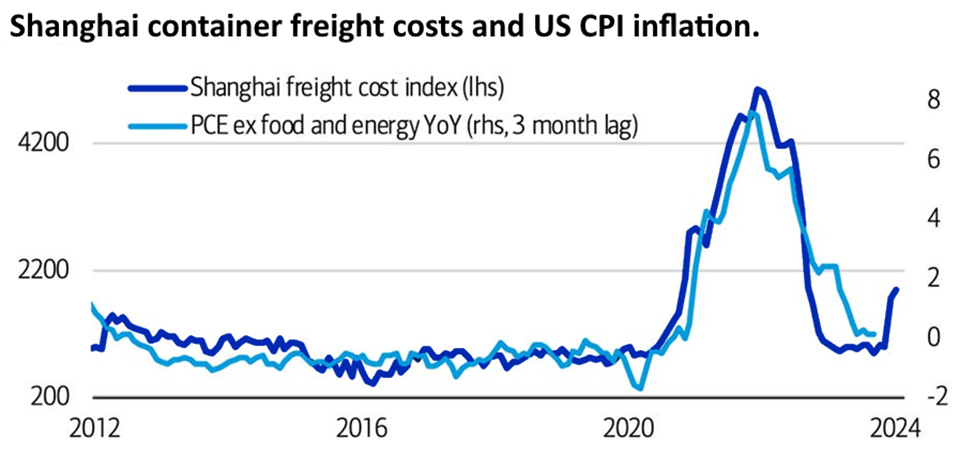

Additionally, the pace of change is a crucial factor, and our models indicate lower year-over-year inflation figures, particularly in the first two quarters of 2024 (refer to Exhibit 11). Furthermore, our projections suggest a probable slowdown in nominal growth for 2024, with a mild recession anticipated in the latter part of the year according to our base forecast. In Exhibit 12, we illustrate the possibility of mild positive goods inflation during this period due to geopolitical events. Simultaneously, we expect a substantial rise in unemployment, and there is a likelihood of a modest further rally in long rates as the Fed contemplates rate cuts at the short end. Consequently, our key takeaway is that, strategically, fixed income instruments might continue to gain from a disinflationary trend in 1H2024, offering an enticing proposition for short-term investors in the U.S.

Exhibit 11: We See Our CPI Model Flattening Out Around Mid-Year 2024 and Slightly Moving Up Almost As 1970’s But Much Lower Rate

Exhibit 12: We see the possibility of mild positive goods inflation this period due to geopolitical events. Supply chain inflation spikes as Red Sea attacks escalate

Nonetheless, we interpret the existing inflation trends as fleeting, and our intention is to steer clear of confusing cyclical shifts with enduring structural changes. We maintain our conviction that long-term investors will encounter a prolonged phase of heightened inflation during this economic cycle. This is driven by the supply side factors integral to our New Economic Order exposition, warranting a distinctive approach to macro strategy and asset allocation. In this context, we recommend overweight positions in revenue streams tied to collateral, encompassing Infrastructure e.g., Energy, Agile Asset-Based Finance, and Real Asset & Real Estate Credit.

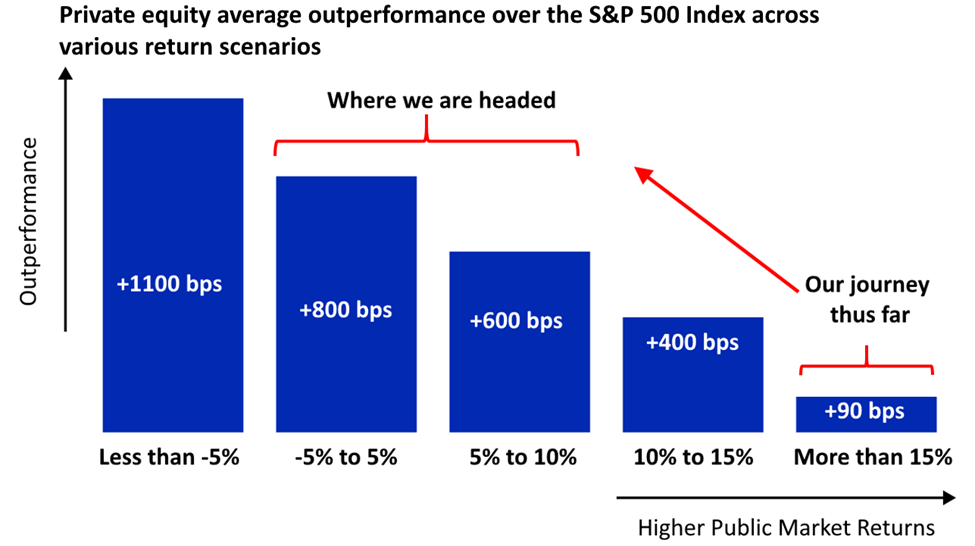

Within the traditional 60/40 equity framework, we also think that control-oriented Private Equity investments can potentially assume a more substantial and crucial role in generating higher returns, especially in a world where our overall expected returns have declined. Our assertion is based on the belief that, despite a higher cost of capital, holding control positions with opportunities for operational enhancement can surpass the performance of a passive index by a significant margin, contingent upon the accuracy of our macroeconomic forecasts. Historical patterns align with this perspective, as depicted in Exhibit 13, indicating the increasing value of the illiquidity premium when public markets shift toward more modest return levels. Contrary to adopting a bearish outlook on Private Equity, the strategic moment for caution was not the current period; rather, it was in late 2021 and early 2022, according to our evaluation, when certain growth-oriented PE investors deployed their capital excessively relative to the trend amid historically low rates (often without adequate hedging).

Exhibit 13: Enhanced PE Performance Amidst Public Market Turbulence is Very Strong. This phenomenon is attributed to improved operational efficiencies and advantageous entry valuations, underscoring the resilience of PE investments.

Exhibit 14 (A)(B): Private Equity Alert – Strategic Deployment Timing is Critical. We emphasize that the opportune moment for cautionary measures fell within the latter half of 2022, not in H12024.

In summary, our inclination is strongly towards adaptable capital in the Credit markets. The absolute yield levels are presently enticing, and the debt quality in expansive, liquid markets such as High Yield is notably elevated. Opportunities arise frequently during market dislocations to navigate in and out of diverse Credit products. Additionally, with a deceleration in economic growth, dispersions are anticipated to widen within and across asset classes. This context emphasizes the preference for flexible capital, particularly in contrast to the prior regime where quantitative easing artificially held down interest rates.

Exhibit 15: With the exception of US (Large); Dispersions including Absolute Valuations Remains Favorable Across Many Parts of the Global Equity Markets

Exhibit 16: Various Credit Segments Present Compelling Opportunities for Total Return Investors

As a point of contrast, we maintain a long-term cautious perspective regarding the role of ‘risk-free’ government bonds within diversified portfolios, questioning their reliability as effective shock absorbers. If our assessment holds true, particularly regarding the ‘40%’ segment of the 60/40 portfolio, we believe it may be overexposed to government debt. Consequently, investors adhering to this allocation strategy might consider utilizing any cyclical rally from current levels to reduce their positions. The reality is that governments, in comparison to corporations and individuals, are currently more burdened by heavy indebtedness.

Moreover, substantial deficits contribute to an ongoing influx of supply into the market, coinciding with the Fed and affiliated banks holding trillions of dollars in bonds marked by unrealized losses. Yields, at their highest levels in multiple years, may attract long-term investors willing to reload the income engine of their portfolios. Thus, if bond prices rally more than expected, we anticipate these interested parties becoming natural sellers. It is crucial to note that, despite the recent bond rally, the stock/bond correlation has remained significantly elevated, reinforcing our argument that bonds may not effectively absorb shocks in the envisioned economic scenario.

What’s our course of action now? Our central message is that, in the midst of the complex dynamics around us, we uphold a “sunny side of shifting currents” to our risk tolerance when contemplating global macro and asset allocation preferences for 2024. Despite an abundance of optimism already reflected in market conditions, our concentration remains on the following favorable thoughts:

- Our assessment suggests that major global central banks are nearing the conclusion of their tightening efforts. In line with this assessment, we posit that bond prices have hit a low point in the near term. The expected disinflationary impact in 2024 aligns with our short-term thesis, even though we project a more modest rally in bonds compared to historical cycles.

- We think thriving in the evolving landscape requires firms to strategically align with both corporate and government initiatives aimed at fortifying supply chains, resources, and national security. Our preference lies with enterprises possessing pricing resilience, robust business models, and solid financial foundations. Opportunities in public equity markets beckon for those targeting established semiconductor producers, manufacturers of semiconductor equipment, and pioneers in industrial automation and technology, pivotal in reshaping the landscape of manufacturing. The surge in demand for natural gas products and sustainable energy solutions aligns with the global pursuit of affordable, reliable, and eco-friendly energy sources. In the realm of private markets, early-stage growth prospects shine, particularly in areas vital for addressing emerging security challenges. The trend toward regionalization /localization /near-shoring has the potential to drive demand for modern warehouses and infrastructure development must be adapted to shifting shipping and logistics patterns.

- Our perspective is steadfast; the bear market in Equities concluded in November 2022. Even with numerous considerations, historical data indicates that returns typically exceed average levels following a 25% decline in the S&P 500, as highlighted in Exhibit 18. It’s not merely relying on historical patterns; what distinguishes the current scenario is the fact that central bank balance sheets remain close to record levels. This positioning empowers them to serve as vital shock absorbers during periods of market turbulence. Despite negative money supply growth in various parts of the world, there is still a substantial amount of money in the global economic system. We believe that this optimistic reality is not fully recognized by market participants, contributing to the sustained support of asset prices. Exhibit 3 further emphasizes this point by illustrating a more substantial cushion compared to previous cycles.

- Our analysis indicates that, despite our projection of a notable deceleration in nominal GDP for 2024, earnings for the cycle likely hit their lowest point in 2Q 2023. More information is available in subsequent sections of this exposition, where we discuss how EPS can experience growth even in the face of a moderating nominal GDP. Supporting this outlook, our Zinqular Model Cycle Indicator points towards a shift from contraction to the initial stages of a cycle recovery, albeit with some expected challenges along the way. This shift is viewed as a positive development.

- The investment landscape is undergoing a profound transformation, propelled by the fusion of advanced innovation and AI tools into a formidable quantitative and systematic investment approach. Despite AI’s roots in the 1950s, the contemporary toolkit, featuring powerful large language models, represents a quantum leap. Investors are now at the forefront of utilizing these AI techniques to systematically distill information from intricate datasets, especially in the dynamic realm of public equity markets. The influx of extensive, complex data, encompassing financial news and regulatory filings, calls for innovative techniques to extract valuable insights. This paradigm shift holds particular significance for investors navigating information inefficiencies in expansive markets such as small caps and emerging market equities.

- Beyond government bonds, the issuance of new supply continues to hover around historically low levels. This has led to a continued strong demand for specific segments of Credit and Equities from a technical perspective. While certain refinancing aspects raise concerns, consumers have extended the terms of their debt, especially prime consumers with mortgages. Furthermore, Private Credit has gained prominence as a viable solution for many corporate borrowers. Significantly, the bulk of the corporate debt maturity wall has been shifted towards 2025-2026, and the predominant near-term maturities are of higher quality (e.g., European High Yield, primarily featuring senior BB, stands out as the market with the most immediate maturity requirements outside of Investment Grade).

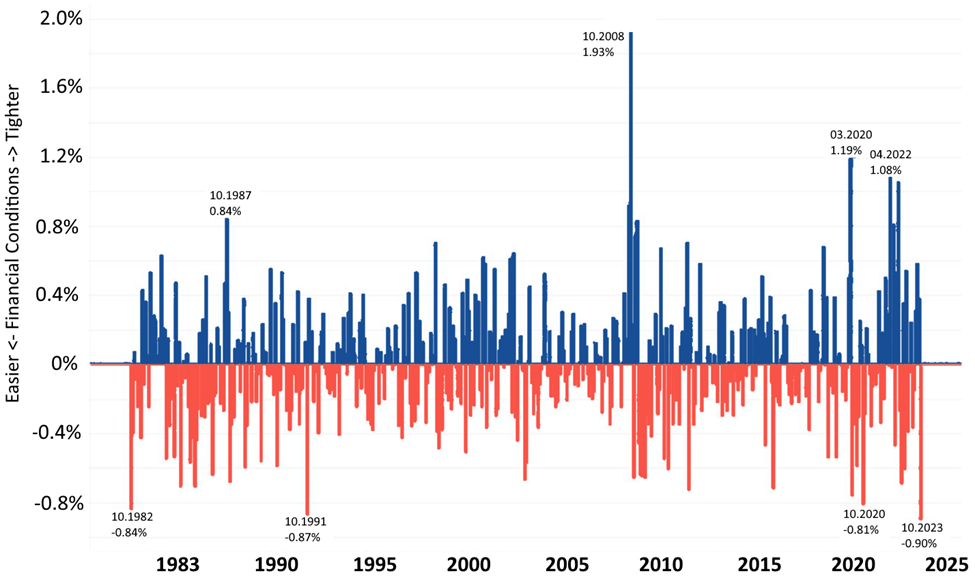

- We believe the unbelievably positive rally in 4Q 2023 as reflected on the Goldman Financial Condition (GFC) index indirectly represented “easing of financial conditions” and/or “interest rates cuts”. What is GFC Index? It is actually the equivalent of fed funds basis points (bps). In November and December, the S&P 500 was up 18% and the Bloomberg US Agg Index saw bonds best month since May 1985. Therefore, this positive equities & bond rally represent a record easing of financial conditions by equivalent of 90 bps of Fed cuts per GFC index data. In plain words – this rally is doing “the work of the Fed” to the tune of about eight 25 bps cuts in the month of November and December. Our view is markets simply do not believe in the Feds “higher for longer” rates narrative. This miscalculation could lead to negative unintended consequences in financial markets (See Exhibit 17).

- To sum up, our “sunny side of the shifting currents” perspectives on investing during this cycle also pertains to our thematic preferences, which we believe can excel in both disinflationary and reflationary scenarios. Contrary to the worries expressed by many investors regarding increasing geopolitical and macroeconomic challenges, we see these challenges as avenues for significant opportunities. Investors who are prepared to invest in solutions to the challenges impacting the global economy can benefit. While not exhaustive, Exhibit 9, outlines areas where we are identifying substantial and appealing opportunities requiring substantial capital investment to address new macroeconomic and geopolitical challenges absent in the prior decade.

Exhibit 17: Without the US Fed Cutting Interest Rates, Public Equity Late 4Q2023 Market Rally Is Equivalent to 90 Fed Fund Basis Points Cut Suggesting “Loosened” US Financial Conditions without Actual Fed Intervention.

Diverging Views from Norm

INFLATIONARY TRENDS:

Except for Japan, our projections for inflation in 2024 deviate from consensus estimates. This departure represents a noteworthy shift in our short-term perspective compared to prevailing expectations in Europe, the U.S., and China.

ECONOMIC GROWTH TRAJECTORY:

Our outlook for 2024 sets us apart from the consensus, with GDP growth projections surpassing expectations in all regions outside of Europe. Our rationale is rooted in the belief that fiscal spending will exhibit greater resilience and yield a more substantial multiplier effect than commonly assumed. Additionally, we anticipate that ongoing labor retention practices and sustained fixed investments will contribute to a reduced unemployment rate across many developed markets in this economic cycle. Notably, in markets like the U.S., conventional recessionary indicators such as capex spending, housing activity, and inventories are still on the path to recovery after reaching a low point this year.

INTEREST RATE OUTLOOK:

Our stance on longer-term interest rates aligns with the “higher for longer” perspective, driven by our expectation of an elevated baseline for inflation in this economic cycle. In the case of the U.S., our 10-year projection for 2024 stands at four percent, in contrast to the consensus of 3.75%. Concurrently, we anticipate the Fed making one or two rate cuts in 2024, as opposed to the consensus expectation of four. In the European context, we foresee yields concluding 2024 at 3%, with an increase to 3.8% in 2025. This contrasts with the consensus figures of 3% and 4.25%, respectively.

EARNINGS PER SHARE AND PROFIT MARGINS:

The era of declining earnings is now in the rearview mirror, marked by five consecutive quarters of net margin contraction. Notably, excluding energy, year-over-year EPS had already returned to positive territory in the second quarter of 2023. Supporting this perspective, our Earnings Growth Lead Indicator has shown an upward turn after reaching its lowest point in 2023. However, our optimism is tempered compared to the consensus. Specifically, we anticipate a six percent year-over-year growth in EPS ($225 per share) for 2024, in contrast to the more optimistic bottom-up consensus projecting an 11% year-over-year increase ($246 per share).

U.S. DOLLAR ASSESSMENT:

Our assessment of the U.S. dollar suggests a more range-bound trajectory in the short term, driven by our expectation of fewer Fed cuts compared to the consensus. Despite secular challenges, we foresee only a gradual depreciation of the U.S. dollar in the subsequent periods. This expectation is grounded in the anticipation that growth, inflation, and rates will persist at elevated levels for an extended duration.

FORECAST FOR ENERGY /OIL:

Our projections indicate that oil prices are expected to find equilibrium within the mid-$73-88 range in 2024, reflecting a moderation in global demand and enhanced global supply. In the more extended term, we maintain the perspective that ‘$80 is the new $60.’ Consequently, our long-term forecasts deviate considerably from futures, which consistently factor in prices declining to the mid-$65-75 range in 2025 and beyond.

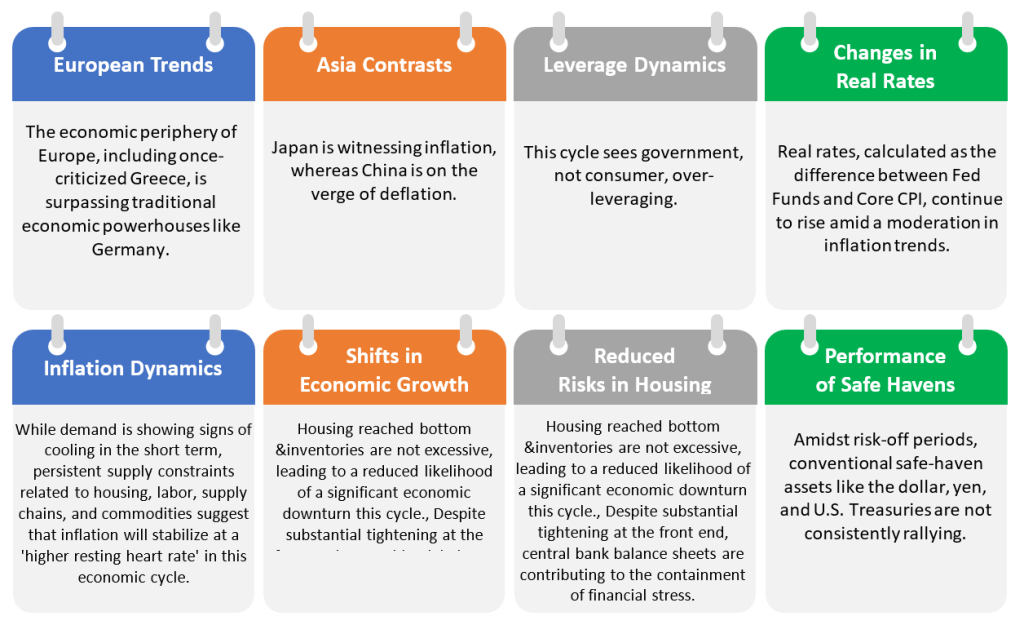

Looking ahead, we do maintain the notion that this cycle exhibits uniqueness; this belief is evident in the table below: This conviction is underscored by the table presented, drawing attention to eight historical macroeconomic disparities that we anticipate will endure.

Notable Features this Economic Cycle

Caution in Interpreting Our Position: While we present a positive perspective for 2024, in our ‘sunny side of shifting currents’ exposition, it is crucial not to misinterpret our stance as indifferent. Reviewing the post-Savings and Loan crisis era data in the 1990s, it is key to acknowledge that the current macroeconomic scenario is as intricate as witnessed in decades. It’s imperative to clarify that, despite not foreseeing a hard landing, this environment does not align with the ideal Goldilocks scenario as indicated by certain proponents of a ‘soft landing’. We think central banks will advocate for patience, especially after witnessing the swift easing of financial conditions in December. Concurrently, a substantial portion of our positive outlook on growth is now factored into market prices, leading to the dissipation of some of the more appealing opportunities we recently highlighted.

Adopt a Calm Approach in Capital Markets: Embrace a calm approach, recognizing that capital market volatility can favor patient, long-term investments. Resist the urge to take unwarranted risks, such as heavily investing in distressed equity, amplifying leverage in acquisition financing, or excessively extending duration. Our steadfast recommendation is to adhere to the philosophy of ‘Keep calm and get back to basics,’ echoing our key message from the 2023 Outlook. As we assess potential concerns in the global financial landscape (within our sunny side of shifting currents), we view that refinancing risk, particularly in battered Real Estate assets and certain Credit segments, will underscore the direct impact of higher rates on cash flows, potentially leading to redistribution back to investors.

The Unpredictability of Geopolitical Shifts: Geopolitical factors continue to be increasingly difficult to predict, posing a potential threat to both growth and market stability. Specifically, with 2024 being a pivotal election year, historical trends suggest the likelihood of political challenges and associated disruptions. Furthermore, our view is that labor costs, whether in the form of rising wages or business interruptions, could have a more substantial impact on profitability than some investors are currently willing to admit. In simple terms, a surge in productivity is necessary to counterbalance the expected rise in wages; otherwise, central banks may not have the leeway to implement easing measures as swiftly as investors hope.

Navigating the Unconventional: Echoing our earlier exploration of the unique characteristics of this economic cycle, it’s clear that traditional reliance on models is inadequate. Investors must actively immerse themselves by establishing ‘local’ connections with clients, executives, and counterparts. An illustrative example is the 2023 reliance on the ISM trajectory, a usual gauge for the S&P 500, which proved excessively pessimistic. Those fixated on this metric overlooked the influential Artificial Intelligence technology mega-trend and the substantial impact of fiscal stimulus injected into the system. In this context, our firm stance is that historical precedent offers limited guidance; this cycle demands a more hands-on and imaginative investment approach, particularly for allocators maneuvering through regional adjustments and assessing relative value across the capital structure.

Next Week Check Out Part B of our 2024 exposition – Sunny Side of Shifting Currents: Global Investment & Economic Outlook 2024