It appears there’s no “losing” left in America’s markets. Even bad bets or poor investments refuse to break. Short-sellers stare at market that will not bleed, supported by liquidity that looks deep but hollow. Price discovery has replaced policy choreography. Every decline is absorbed before it can become a correction; every signal that once meant “crash” is neutralized in advance. So what exactly is happening?

- The Repo Alarm: Liquidity Without Life.

The 1st cracks are showing in the repo market. Over $20B was recently pulled through the Fed’s standing repo facility; the highest level since Covid & 2nd highest in history. This not a sign of strength. It signals collateral stress & thinning liquidity buffers at the core of the banking system.

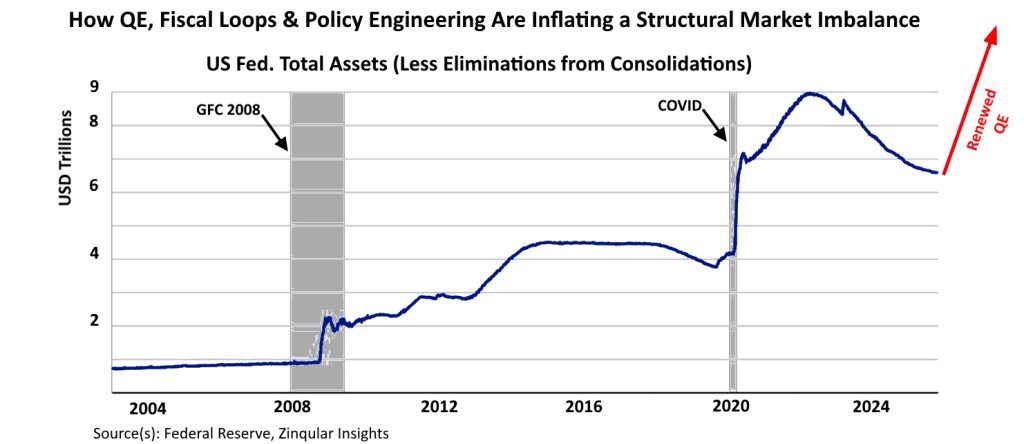

In a functioning market, such strain would trigger price adjustment & risk repricing. Instead, the Fed steps in; pretending all is normal: pumping synthetic liquidity into a system on life support and calling it “stability.” Policy now acts as an intravenous line, keeping a corpse animated. The traditional crash indicators: rising repo use, balance sheet constraints, dollar stress; are sterilized through policy backstops: Treasury buybacks, standing facilities, and QE in disguise. The result is an illusion of health, a market sustained by intervention. - QE Reversed: From “Stimulus into Depression” to “Stimulus into Bubble”.

Quantitative Easing (QE) was once a lifeline during crisis is now a stimulus into depression. Today, it is fuel on the fire. Asset valuations hover at record highs; the S&P 500 earnings yield (~4.4%) barely compensates for the 10-year Treasury yield (~4%), leaving the equity risk premium at historic lows. Real growth remains steady, unemployment modest & inflation persistently above target. Liquidity is abundant, and credit spreads are near record tightness.

In this environment, renewed QE becomes accelerant, not support. It no longer re-liquifies private markets; it monetizes public debt, financing persistent deficits through short-term Treasury issuance. The result is a monetary-fiscal feedback loop that inflates asset prices, suppresses volatility & reinforces the illusion of perpetual growth.

This policy framework has evolved from defensive to speculative. It is a macro experiment built on faith in AI-driven productivity, fiscal leniency & the belief that central banks can permanently suspend market gravity. Every bubble is synthetic; every correction pre-cancelled.

When liquidity is artificial & volatility is suppressed, traditional hedges fail. Equity correlations rise, fixed income loses diversification value & nominal assets become increasingly policy-dependent. The key for investors is to anchor portfolios in real, cash-generating, long-duration assets that are less sensitive to central bank engineering & more aligned with tangible economic demand.