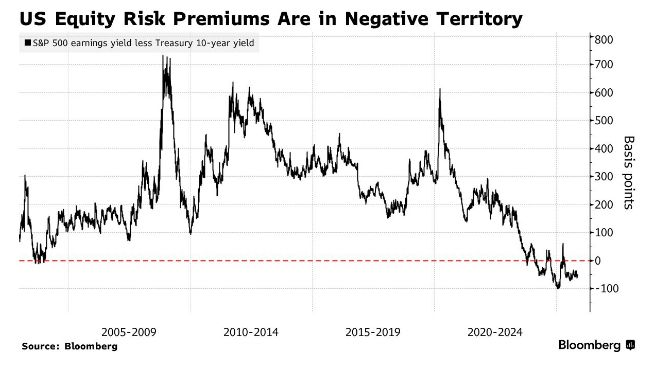

The equity risk premium (EqRP) turning negative is like a tightrope walker continuing across a high wire after the safety net has been removed. For years, investors relied on the EqRP as that net; a buffer ensuring equities offered higher returns than risk-free Treasuries. Today, that protection is gone. The S&P 500’s earnings yield has slipped below the 10-year Treasury yield, leaving investors balancing on confidence rather than fundamentals.

This precarious state didn’t arrive suddenly; it crept in like a boiling frog unaware of the rising heat. Over a decade of low rates, quantitative easing, and abundant liquidity has dulled investors’ sensitivity to risk. Each incremental stretch in valuation felt justified until, slowly, the market found itself in scalding water, with minimal reward for substantial exposure. Unless corporate profits surge or yields retreat, equities risk being left behind in the race for value.

And as the traditional lighthouse of valuation guidance; the EqRP, dims in the fog, investors are left to navigate uncertain waters. Old metrics no longer offer clear direction, and faith in long-term growth has replaced objective compensation for risk. The chart is not just a snapshot of numbers; it’s a warning that the balance between reward, risk, and reason has shifted profoundly. So what do we think of this?

1) Investor complacency has reached a critical point: Markets are accepting higher risk with diminishing compensation, reflecting overconfidence in growth and stability.

2) Bonds may reclaim strategic importance: With Treasury yields surpassing equity earnings yields, the traditional preference for stocks over bonds is losing its rationale.

3) A market recalibration is inevitable: Either earnings must accelerate, or valuations will need to correct; restoring a more sustainable equilibrium between risk and return.

4) Finally, risk now rests squarely with retail investors. Household equity ownership has soared to 52%, a stark increase from 25% in the aftermath of 2008, marking the highest level in history. Plus US equities are extremely overvalued!

As the market navigates this new reality, discipline becomes paramount. A renewed focus on quality, cash flow resilience, and valuation awareness is essential. While opportunities remain, they require a more selective, risk-aware approach. In a world where the safety net has been removed, investors must reassess not only where returns will come from—but how much risk they are willing to assume to earn them.